Applying for Private Loans

Students may apply for private or alternative loan programs through their preferred lenders. Private loans will not be certified for more than the student's cost of attendance minus other financial resources that the student is receiving. Additionally, private loans certification requests may not be completed until a student is registered for courses in the term. Further, students are subject to the criteria as determined by the individual lender.

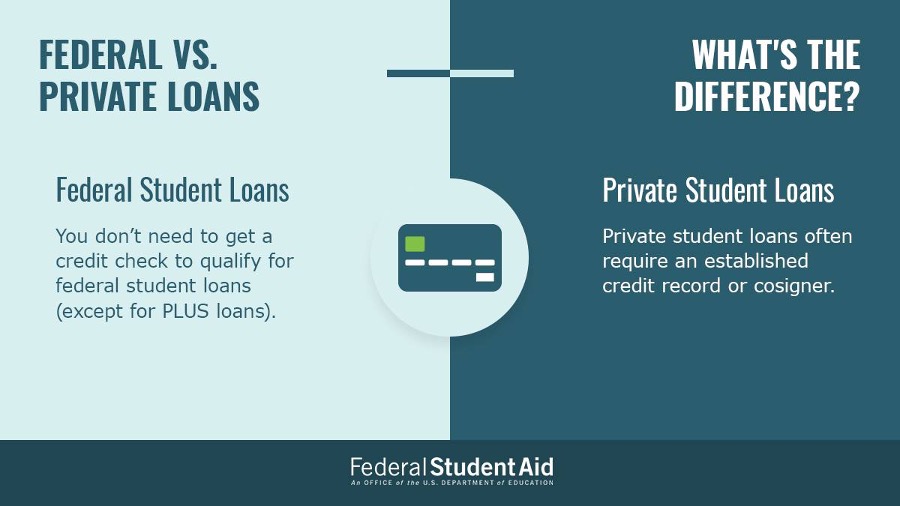

It is recommended for students to apply for federal aid before applying for private or alternative loans t be informed on all available educational financing options. Other restrictions or requirements may apply in order for a private or alternative loan to be disbursed. Students are encouraged contact Financial Aid & Scholarships Office for more information regarding the requirements to obtain a private educational loan.

Use school code 004508.

Use the Loan Term Dates listed below to apply for the appropriate loan period.

You may review and compare lender offerings using these links:

Loan Period Dates

Fall & Spring

August 1 - May 30

Fall Only

August 1 - December 20

Spring Only

January 15 - May 20

Summer Only

June 1 - July 30

Borrower Rights

The Higher Education Opportunity Act of 2008 (HEOA) added section 128(e)(3) to the Truth in Lending Act (TILA) which requires private loan lenders to obtain a completed and signed Self-Certification Form from the applicant. In addition, the private loan lender must provide disclosures to borrowers at different stages of the application process. Please contact us for a copy of the Self-Certification Form if your lender does not provide one.

Know Your Rights! Read and understand your rights and responsibilities before you borrow a loan.

Applying for a Loan to Pay a Prior Term (Past Due) Balance

Certain private loan lenders offer loans to cover a past due balance from a prior term or academic year. Many lenders will allow you to apply up to 6 months after the past due balance is created. However, you should check with your lender as the time-frame to apply ranges from one month to one year.

CU Denver must receive the lender’s certification request for prior term balance loan no later than September 15th of the following academic year. CU Denver will only certify prior term balance loans to cover an outstanding balance on your CU Denver student account.

Next Steps

After Applying for Your Private Loan

The Financial Aid & Scholarships Office will notify you by email once we have received and reviewed the private loan certification request from your lender. The loan amount processed by the Financial Aid & Scholarships Office may be less than the amount you requested if you have not accepted or declined your other loans, or if the requested amount exceeds your COA. You may contact our office to discuss the loan amount before the loan certification process is completed.

You will be required to complete Private Loan Entrance Counseling before the certification request is processed.

Loan

funds will be sent to the university and will be applied to any

outstanding balance due on your student account. Any remaining funds

will be sent to you by the Bursar’s Office via direct deposit or mail.

Loan Increases

Once

our office has certified an approved private loan, we will rarely be

able to increase the loan amount. In most cases, you will need to apply

for a new loan.

Loan Reductions and Cancellations

- If

we have not notified you that we received the private loan

certification request from your lender, please work with your lender to

reduce or cancel the loan.

- If we have notified you that we received the private loan certification request, you will need to complete a Loan Adjustment Form.

- If you receive additional aid after your private loan is certified, our office may need to adjust the amount of your private loan. We will notify you if your loan needs to be adjusted.

What now?