Private Student Loans

If you apply for financial aid, you will likely need to borrow federal and or private student loans as part of your financial aid package. We strongly encourage students to exhaust all federal loan eligibility before borrowing a private student loan as federal loans generally have better terms and conditions. Below is some general information about each type of loan. To learn more, visit our Student Loans page.

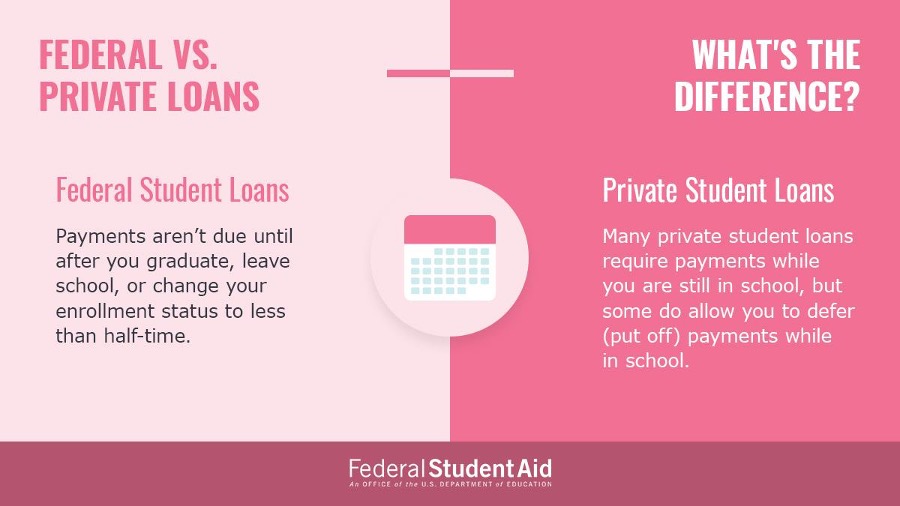

- Federal student loans are made by the government, with terms and conditions that are set by law, and include many benefits (such as fixed interest rates and income-driven repayment plans) not typically offered with private loans.

- Private student loans are non-federal loans, made by a lender such as a bank, credit union, state agency, or a school. These are credit-based loans and the applicant and cosigner will be required to complete a credit application. Private loans cannot be consolidated with federal loans. If you elect to borrow a private student loan, the Financial Aid & Scholarships Office is able to certify the loan up to your Cost of Attendance minus any other aid you have received.

Before Applying for Private Student Loans

Determine Eligibility for Federal, State and Institutional Aid

Complete the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for federal, state, and institutional aid. Review your Student Aid Report (SAR) and respond promptly to any requests for additional information from the Financial Aid & Scholarships Office. We strongly encourage students and families to learn about the differences in Federal vs. Private student loans in order to make an informed decision.

Eligible undocumented students who do not meet the basic eligibility criteria for federal student aid, but who qualify for Colorado ASSET (Advancing Students for a Stronger Economy Tomorrow) are encouraged to complete the Colorado Application for State Financial Aid (CASFA) to determine your eligibility for aid through the State of Colorado.

Research and Apply for Scholarships

Scholarships are gifts, and in most instances, do not have to be repaid. Visit our Scholarships page for information on applying for scholarships through CU Denver.

Determine How Much To Borrow

- Review your financial aid offer in UCDAccess (if applicable).

- Compare your financial aid offer to your Estimated Cost of Attendance (COA).

- Remember that the total amount of aid you can receive from all sources, including scholarships, grants, work-study, and loans, cannot exceed the COA.

Ready to choose a lender and apply for private loans?

Students may apply for private or alternative loan programs through their preferred lenders. Private loans will not be certified for more than the student's cost of attendance minus other financial resources that the student is receiving. Further, students are subject to the criteria as determined by the individual lender.

It is recommended for students to apply for federal aid before applying for private or alternative loans to be informed on all available educational financing options. Other restrictions or requirements may apply in order for a private or alternative loan to be disbursed. Students are encouraged contact Financial Aid & Scholarships Office for more information regarding the requirements to obtain a private educational loan.

You may review and compare lender offerings using these links:

Ready to Apply?

Have you already selected a lender and are now ready to apply for your private student loan?